tax deductions for high income earners 2019

Theyre contributing 1300 to. Your income places you in the 35 in the IRS 2022 tax bracket.

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

Now in 2022 a higher standard deduction of 12950 for individuals and 25900 for joint filers make it harder for high-income earners to find enough deductions to itemize.

. It would look like the following. Lets start with an overview of tax rules for high-income earners. These include mortgage interest and property tax deductions and deductions for charitable contributions.

Your tax savings will therefore be around 1400. Ad Free shipping on qualified orders. Prior year 2019 earned income.

Schedule K-1 income is in turn reported on the partners income tax returns. Free easy returns on millions of items. Tax deductions for high income earners 2019 Tuesday June 14 2022 Edit.

Tax deductions for high income earners 2019 Tuesday June 14 2022 Edit. Find Helpful Tips Along The Way Like Which Debts to Pay First and How Much To Pay. The benefit of credits and exemptions is also reduced as income rises.

Browse discover thousands of brands. IRS Tax Reform Tax Tip 2019-28 March 21 2019. Contributions to a qualified retirement plan such as a traditional 401 k or 403 b.

Important figures for 2022 include the following. You may take an itemized deduction for contributions of. 5 Outstanding Tax Strategies For.

Read customer reviews find best sellers. For 2018 the maximum elective deferral by an employee is 18500 and for the 2019 tax year. Establish a donor-advised fund.

Prepare your 2019 Alabama state return for 1799. Ad With a Few Steps The Tool Could Help You Make a Plan Based on Your Budget. How To Reduce Taxable Income For High Income Earners In 2021.

The SECURE ACT makes a number of significant modifications that have an impact on high-income earners tax minimization tactics. Whereas that deduction used to be unlimited its now capped at 10000 a year. Well Help You File Your Alabama State Tax Return Online.

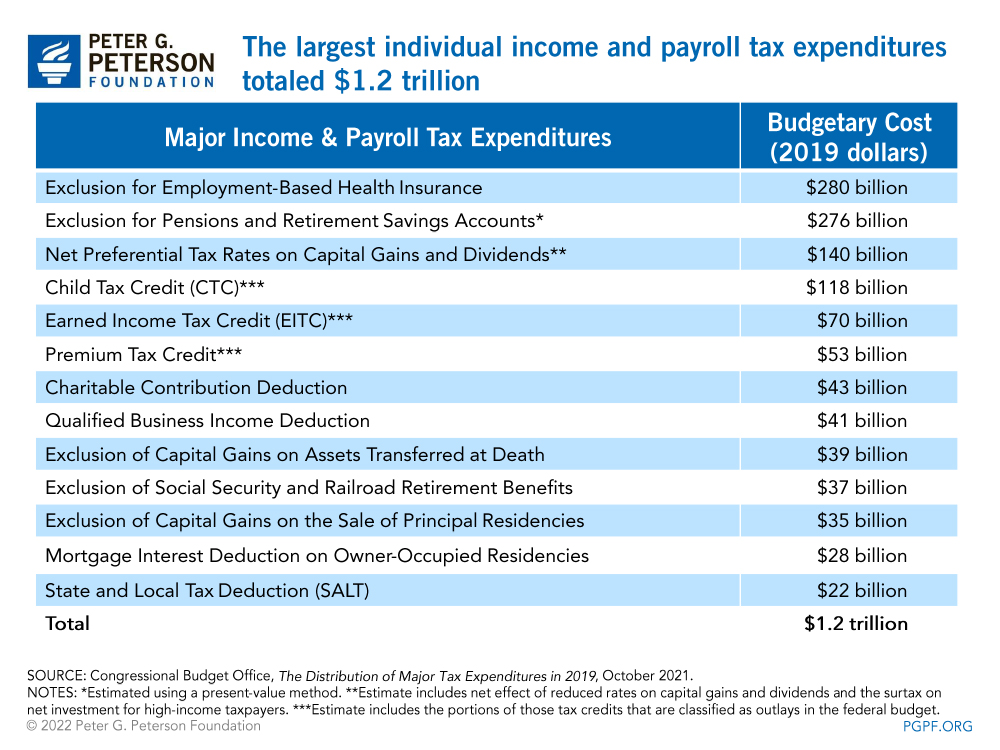

If youre charitably inclined charitable contributions can provide outstanding tax benefits. The next two largest deductions claimed by high-income households in 2014 were the charitable deduction 108 billion and the home mortgage interest deduction 63 billion. WASHINGTON The Internal Revenue Service today urged high-income taxpayers and those with complex tax returns to check their withholding.

The age for Required Minimum Distributions RMDs from retirement accounts was. Long-term capital gains tax. Contrast this to a worker earning 10200 per year.

Tax law changes in the Tax Cuts and Jobs Act affect almost everyone who itemized deductions on tax returns they filed in. Premium Federal Tax Software. Ad Free prior year federal preparation.

The Relationship Between Taxation And U S Economic Growth Equitable Growth

Who Benefits More From Tax Breaks High Or Low Income Earners

Medical Doctor Tips For Tax Bracket Planning

For The First Time In History U S Billionaires Paid A Lower Tax Rate Than The Working Class The Washington Post

Who Benefits More From Tax Breaks High Or Low Income Earners

How Do Taxes Affect Income Inequality Tax Policy Center

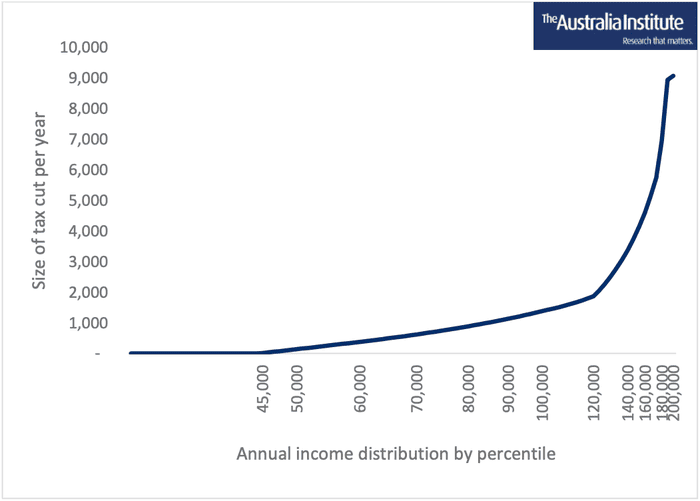

Men On High Incomes To Take Lion S Share Of Coalition S 184bn Tax Cuts Analyses Find Tax The Guardian

Personal Income Tax Brackets Ontario 2020 Md Tax

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

2021 2022 Income Tax Calculator Canada Wowa Ca

The 4 Tax Strategies For High Income Earners You Should Bookmark

Ontario Income Tax Calculator Wowa Ca

Working Income Tax Benefit Recipients In Canada

In 1 Chart How Much The Rich Pay In Taxes The Heritage Foundation

Why Are The Taxes So High In Canada What Benefits Does A Citizen Get From The Government Against This Tax Payment Does It Commensurate With The Benefits Quora

Personal Income Tax Brackets Ontario 2021 Md Tax

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times